Financial Inclusion is Dead. Welcome Economic Empowerment.

This Article discusses:

- Why Banking the Unbanked Fails and why it is an Illusion of Financial Inclusion and

- How rethinking Financial Inclusion is the Path to True Economic Empowerment

Summary: In this article, we challenge the notion of financial inclusion and delve into the true essence of economic empowerment. While banking services and access to Financial services are crucial, we must go beyond and empower individuals to become drivers of local economies. Discover how Chimoney's mission to unlock economic opportunities for everyone aligns with this transformative journey, providing efficient global payouts for a more inclusive and empowering future where people can earn, get paid, and spend as they please. Join us in reshaping perspectives and fostering meaningful change.

Introduction

In today's world, there is a pressing need to address the challenges faced by the unbanked population, especially in emerging economies in some African and Asian Countries. Financial inclusion has been widely touted as the solution to uplift millions out of poverty. But let's face it - has it really lived up to its promise? In this thought-provoking article, we delve deep into the realities of financial inclusion and explore a bold new approach toward true economic empowerment. We introduce Chimoney, our global payouts platform and network of payment networks that transcend the boundaries of conventional banking services and established payment rails, and revolutionize the way individuals earn, get paid, and spend.

The Limited Impact of Banking Services and Fintechs

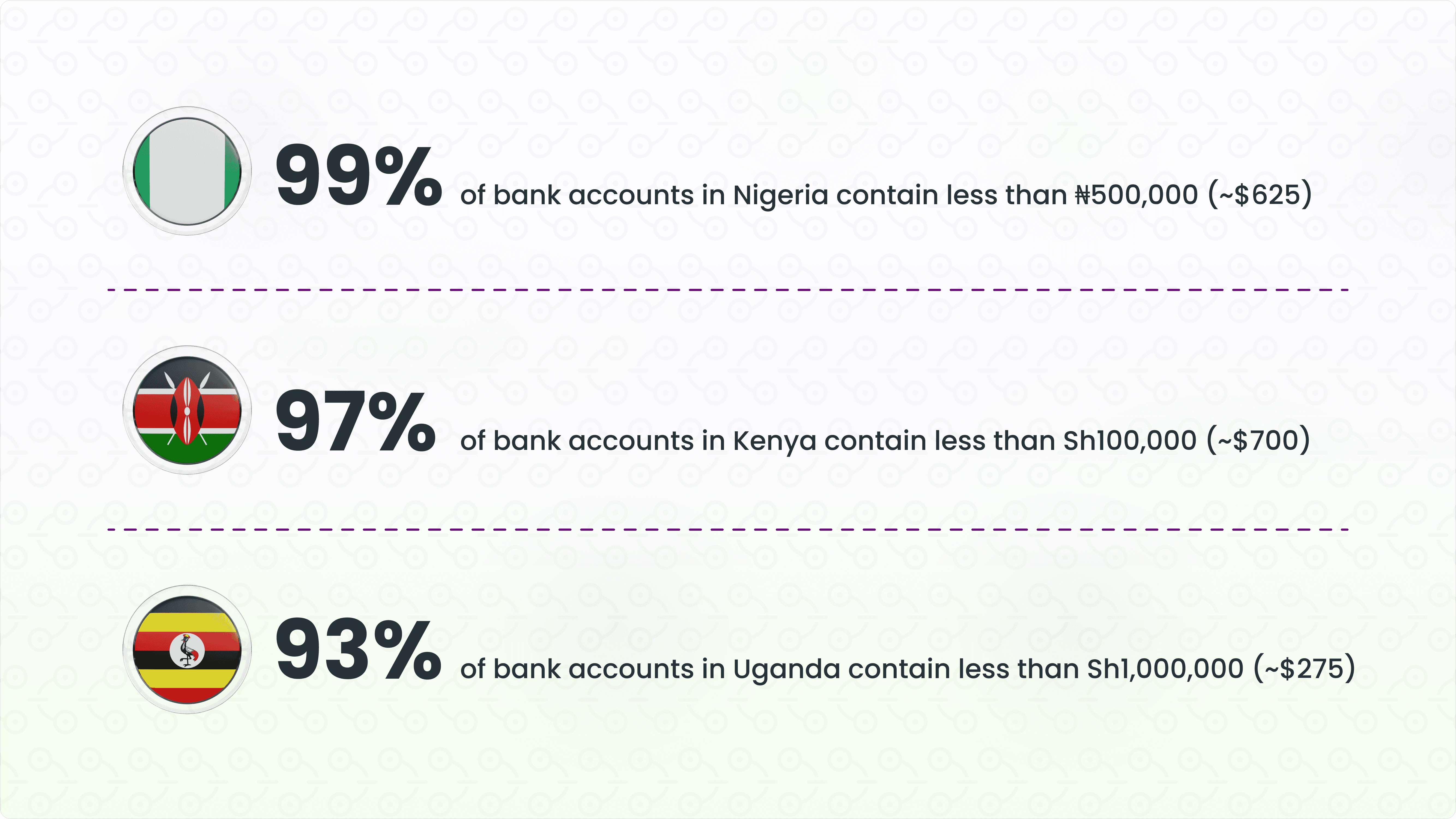

While financial inclusion has made remarkable strides in opening bank accounts or providing offline mobile wallets for the unbanked, the hard truth remains that mere access to banking services does not guarantee prosperity. Surprisingly, a significant percentage of bank account holders across Africa and other emerging economies in the world have balances of less than $1000. For example, according to Afridigest:

- 99% of bank accounts in Nigeria contain less than ₦500,000 (~$625).

- 97% of bank accounts in Kenya contain less than Sh100,000 (~$700).

- 93% of bank accounts in Uganda contain less than Sh1,000,000 (~$275).

Clearly, we must question whether we are making genuine progress in empowering the unbanked or simply providing a label that overlooks the root causes of financial insecurity, namely, limited access to global opportunities, unequal distribution of opportunities for creating value, and lack of option for getting paid for the value created.

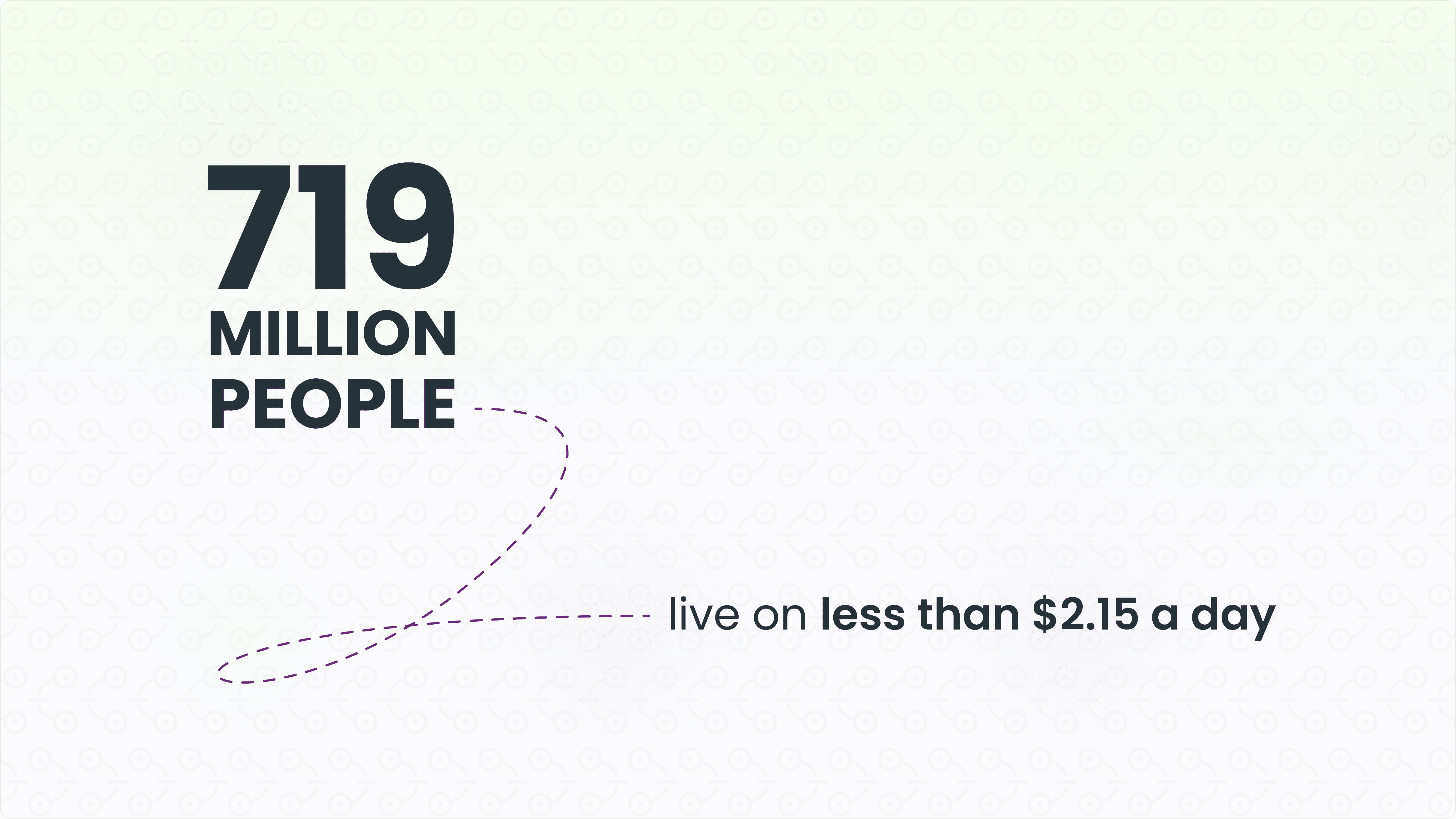

The Illusion of Financial Inclusion

Our pursuit of financial inclusion must confront a daunting reality - it often creates an illusion of success while neglecting the critical systemic issues that perpetuate economic inequality. Let's face it; opening a bank account or getting a crypto wallet does not magically resolve the struggles the unbanked face. The ability to transfer crypto or do p2p transfer does not enable users to spend on products and services that make a difference for them and their families. Access to banking is not access to food, clothing, and shelter: needs that are still unmet for over 719 million people — 9.2% of the world’s population — who are living on less than $2.15 a day globally. It's time to challenge the status quo and explore more effective alternatives to uplift those who need it the most.

Chimoney: Unlocking Economic Opportunities for Everyone

Introducing Chimoney - an audacious vision to redefine financial inclusion and drive genuine economic empowerment through unlocking Economic Opportunities for Everyone. At Chimoney, we believe in empowering individuals with more than just conventional banking services. Our Global Payouts Platform and Network of Payment networks, APIs, and SDKs open doors to an array of financial options that empower users to receive payment in a method that is locally relevant and impactful for them.

Chimoney gives users everywhere the power to pick from a buffet of cashout options and get paid exactly how they like to get paid. Chimoney's global payouts platform is designed to unlock the untapped potential of the unbanked.

At Chimoney, we believe in a world where access to financial services should be seamless and devoid of exorbitant fees that eat away at hard-earned money.

We envision a world where financial freedom and fair recognition of value is within reach for every individual, breaking the cycle of poverty one step at a time.

Beyond Banking: Empowering users with Financial Choice

It's time to embrace a holistic approach to financial empowerment. At Chimoney, we go beyond sending payments to traditional bank accounts. We enable users to receive payment to emails, phone numbers, social media accounts, and even directly to their offline wallets like MPESA in Kenya. We also empower and educate users to hold their funds in their preferred currency and connect them to the global commerce ecosystem where they can buy from Amazon and Shopify stores regardless of their location or situation. By empowering individuals to earn globally, spend without borders and transfer seamlessly, we create a ripple effect that uplifts entire communities.

A Catalyst for Economic Growth

True economic empowerment goes beyond individual gains; it is a catalyst for collective growth. As we empower individuals to take charge of their financial futures, they become drivers of local economies, contributing to job creation and sustainable development. Here's how Chimoney fits into this economic empowerment framework:

-

Enable People to Get Paid for Work Done: Chimoney's platform streamlines global bulk payouts, ensuring that freelancers, contractors, community members, and remote workers receive timely payments for their services, no matter where they are in the world. By facilitating quick and efficient cross-border transactions, individuals can focus on their work without worrying about delayed or complicated payment processes. This, in turn, contributes to a more inclusive global economy by empowering workers with fair and transparent compensation and giving them the power to decide how they want to cash out.

-

Facilitate Stipend and Perk Payments to Global Communities: Chimoney's solution is not limited to individual payouts. It also supports organizations and businesses in distributing stipends, incentives, and perks to their global communities. Whether it's a remote team, a network of volunteers or ambassadors, or a community of content creators, Chimoney's platform enables seamless and secure mass payouts, fostering loyalty and engagement among community members. This financial support further amplifies the impact of these communities, driving economic growth within their respective countries and local communities.

-

Empower Builders with API to Launch Fintech Startups: Chimoney's commitment to economic empowerment extends beyond its own platform. Through our robust API and SDKs, Chimoney empowers developers and fintech enthusiasts to create innovative financial solutions. By providing easy access to global payout capabilities, aspiring entrepreneurs can launch their fintech, education, HR, and commerce startups and contribute to enhancing financial inclusion. This democratization of financial technology fosters entrepreneurship, drives innovation, and nurtures a vibrant fintech landscape, positively impacting economies at both local and global levels.

-

Support Communities and Programs like SheCodeAfrica and Ingressive4Good: Chimoney is dedicated to supporting initiatives that promote diversity, inclusion, and economic empowerment. By partnering with organizations like SheCodeAfrica and Ingressive4Good, Chimoney extends its services to enable seamless transactions for scholarships, grants, and financial support to underrepresented groups. Through these collaborations, Chimoney actively participates in creating opportunities and driving economic progress for communities that may otherwise face barriers to financial inclusion.

By aligning its mission with broader economic empowerment goals, Chimoney plays a vital role in transforming financial access and opportunities for individuals, communities, and businesses alike. As the world embraces a future of economic empowerment, Chimoney stands ready to be a driving force behind this positive change.

We believe that economic growth and prosperity should be accessible to all, irrespective of their current financial status and we're willing, ready and able to unlock economic opportunities for everyone.

Conclusion

The time has come to break free from the shackles of the illusion of financial inclusion. Let's unlock economic opportunities for everyone with open arms, paving the way for a brighter future for millions around the world. Chimoney's platform sets a new benchmark for financial empowerment, ushering in an era where economic independence is not just a dream but a tangible reality.

Check out these other posts

Why 2025 Is The Year AI Agents Get Their Own Wallets (And Passports)